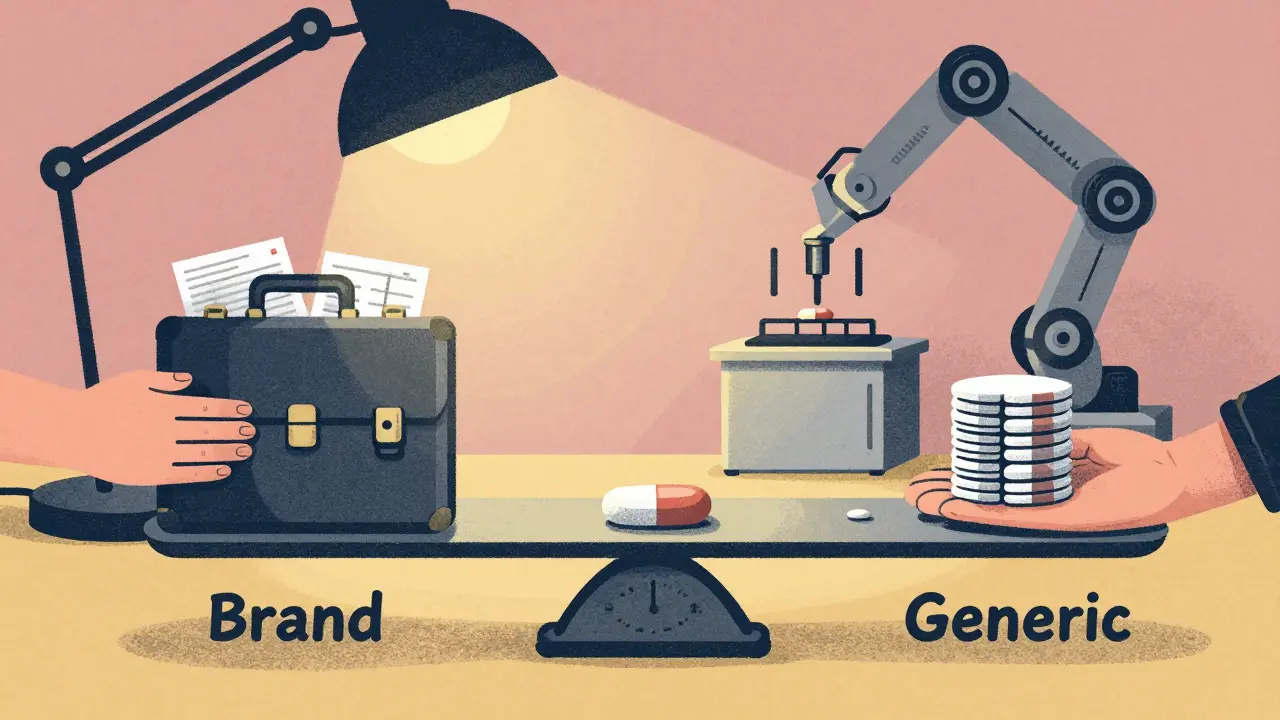

When you pick up a prescription, you probably don’t think about who made it or how much it cost to produce. But the difference between a generic pill and its brand-name counterpart isn’t just in the label-it’s in the labor, the process, and the hidden economics behind every tablet. Generic drugs make up 9 out of 10 prescriptions filled in the U.S., yet they cost a fraction of the brand-name version. Why? The answer lies not in cheaper ingredients, but in how labor is structured, scaled, and managed on either side of the production line.

Why Generic Drugs Cost Less-It’s Not Just the Active Ingredient

Many assume generic drugs are cheaper because they use the same active ingredient as the brand. That’s true-but the active ingredient only makes up about 10-15% of the total cost. The real savings come from labor efficiency, volume, and simplified processes. Brand-name drugs require years of clinical trials, regulatory filings, and patent protection before they even hit the market. That process costs around $2.6 billion and takes 10 to 15 years. Those expenses get baked into the price. Generic manufacturers skip all that. They don’t need to fund research or run new trials. They just need to prove their version is bioequivalent. That cuts out massive overhead.

But even within manufacturing, labor costs tell a different story. For brand-name drugs, labor accounts for 30-40% of total production costs during early-stage manufacturing. This includes highly trained scientists, quality assurance teams, regulatory specialists, and engineers working on complex formulations. Every batch is closely monitored, every deviation logged, every change approved. It’s expensive because it’s novel.

Generic manufacturers, on the other hand, operate at scale. Their labor costs are typically 15-25% of total production. That’s not because they pay workers less-it’s because they do the same thing over and over, millions of times. When production volume doubles, generic manufacturers see a 27% drop in unit cost. That’s economies of scale in action. A single production line can churn out 10 million tablets a month. The same worker who once checked 500 batches a week now checks 5,000. The cost per hour of labor drops dramatically.

The Hidden Labor Burden: Quality Control and Compliance

Don’t be fooled into thinking generic drug production is low-skill. Quality control alone takes up more than 20% of total production costs for generics. That’s labor-intensive work. Every raw material shipment gets tested. Every intermediate batch gets sampled. Every final product gets checked for potency, purity, and dissolution rate. And every step must be documented to FDA standards.

For a medium-sized generic manufacturer with 20 to 500 employees, just maintaining compliance systems costs about $184,000 a year. Add in program participation fees and new drug application costs, and you’re looking at over $2.2 million annually just to stay legally compliant. That’s mostly labor: inspectors, documentation specialists, auditors, and regulatory affairs staff. These aren’t low-wage jobs. These are trained professionals who know the Code of Federal Regulations like the back of their hand.

Brand-name companies also spend heavily on quality control-but they spread those costs across fewer products. A brand might have five drugs on the market. A generic company might have 200. The per-product labor cost for compliance is much lower for generics, even though the total labor spent on quality is higher.

Where the Work Happens: Global Labor Arbitrage

Most active pharmaceutical ingredients (APIs)-the core chemical that makes the drug work-are made overseas. About 80% of APIs used in U.S. generic drugs come from India and China. Why? Because labor there is about 42% cheaper than in the U.S. This isn’t just about wages. It’s about infrastructure, regulatory enforcement, and scale. Factories in these countries run 24/7 with large workforces performing repetitive tasks at lower hourly rates.

But here’s the catch: that cost advantage doesn’t mean those factories are more efficient. According to the HHS Office of the Assistant Secretary for Planning and Evaluation, the lower prices come from subsidies, weaker labor protections, and environmental standards that aren’t enforced the same way. So when you buy a generic drug, you’re benefiting from a global labor system that’s structured very differently from the one behind brand-name production.

That’s why some U.S.-based generic manufacturers are investing in automation. They’re installing robotic arms for packaging, AI-powered vision systems for inspection, and digital batch records to reduce paperwork. It’s not about replacing people-it’s about reducing the number of people needed per unit produced. One company in Ohio replaced 12 manual inspection roles with a single automated system that works faster and with fewer errors.

Outsourcing: The Quiet Shift in Labor Strategy

More and more generic manufacturers don’t own their factories anymore. They outsource production to Contract Manufacturing Organizations (CMOs). In fact, biosimilar manufacturers now spend 42% of their production costs on CMOs-up from 28% just five years ago. This shift turns fixed labor costs into variable ones. Instead of paying salaries for 100 full-time employees, a company pays per batch produced. If demand drops, they scale down. If demand spikes, they bring in extra capacity.

This model gives generic companies flexibility but also creates instability. CMOs are under pressure to cut costs to stay competitive. That means they may hire less experienced workers, reduce training hours, or delay equipment upgrades. The FDA has warned that this pressure could lead to supply shortages and quality issues. In 2022, a shortage of a common blood pressure medication was traced back to a CMO that cut its QA team by 30% to reduce costs.

Competition Drives Labor Efficiency-Sometimes Too Far

There are hundreds of companies making generic versions of the same drug. When five companies make the same pill, the price drops. When ten do, it drops again. That’s good for consumers. But it puts pressure on manufacturers to cut every cost-including labor.

Some companies respond by investing in automation and training to boost productivity. Others cut corners. The FDA’s 2023 report notes increasing concern that “lower cost of generic drugs may place pressure on companies to adopt strategies that lower the cost of manufacturing.” That could mean fewer inspectors, less retesting, or rushed documentation. In one case, a generic manufacturer was cited for falsifying lab records because their QA team was stretched too thin.

But the smartest companies are doing the opposite. They’re investing in prevention-better training, better systems, better communication between departments. One manufacturer in North Carolina reduced rework by 60% in two years by training staff to spot errors before they happened. That didn’t reduce headcount-it improved retention, cut waste, and lowered long-term costs.

What This Means for You

When you save money on a generic prescription, you’re not just saving on chemicals. You’re benefiting from a complex, global system of labor efficiency, scale, and strategic outsourcing. But that system is fragile. It depends on skilled workers, strict oversight, and fair competition. When companies cut too deeply to stay profitable, the risk of shortages or quality issues rises.

The next time you pick up a generic pill, remember: it’s not just cheaper because it’s copied. It’s cheaper because thousands of workers around the world have optimized every step of production-often under intense pressure. And that optimization is a balancing act between affordability and safety.

There’s no perfect solution. Brand-name drugs are expensive because they fund innovation. Generic drugs are cheap because they’re mass-produced. But both rely on people-scientists, technicians, inspectors, and assembly-line workers-to make sure what ends up in your medicine bottle is safe, effective, and reliable.

Why are generic drugs so much cheaper than brand-name drugs if they have the same active ingredient?

Generic drugs are cheaper because they don’t need to cover the $2.6 billion cost of research, clinical trials, and patent protection that brand-name drugs do. They also benefit from economies of scale-producing millions of doses on the same lines-reducing labor and overhead costs per unit. While the active ingredient is identical, the production process is simpler and optimized for volume, not innovation.

Do generic drug manufacturers pay workers less than brand-name companies?

Not necessarily. Workers in both sectors often have similar qualifications and pay scales. The difference is in volume and efficiency. Generic manufacturers produce far more units per employee, so the labor cost per pill is lower. Some generic companies outsource to countries with lower wages, but U.S.-based generic facilities typically pay comparable wages to brand-name firms. The savings come from doing the same task faster and more often, not from paying less.

Is quality lower in generic drugs because of lower labor costs?

No. Generic drugs must meet the same FDA standards as brand-name drugs. Every batch is tested for potency, purity, and how it breaks down in the body. The difference is in how labor is deployed. Generic companies invest heavily in quality control because one mistake can lead to recalls, lawsuits, or lost contracts. The lower labor cost per unit doesn’t mean less oversight-it means better systems, automation, and volume-driven efficiency.

Why do some generic drugs have shortages?

Shortages happen when the price is too low for manufacturers to make a profit. If a generic drug sells for $0.05 per pill and production costs $0.04, there’s little room for error. If labor, materials, or compliance costs rise-even slightly-companies may stop making it. This is especially true for older drugs with many competitors. When profit margins shrink, some manufacturers cut staff or reduce quality checks, which can lead to production delays or FDA warnings.

Are generic drugs made in the U.S. safer than those made overseas?

Not necessarily. The FDA inspects all facilities-U.S. and foreign-that supply drugs to American patients. In fact, more than half of all generic drug manufacturing sites are overseas, and they’re held to the same standards. The risk isn’t location-it’s oversight. Some foreign facilities have had violations, but so have U.S. ones. What matters is whether the manufacturer follows FDA rules, not where the factory is located.

Can automation reduce labor costs in generic drug production without hurting quality?

Yes. Automation can reduce errors, improve consistency, and cut labor costs without sacrificing quality. For example, robotic inspection systems can detect defects faster and more accurately than humans. Digital batch records eliminate manual paperwork, reducing documentation errors. Companies that invest in automation often see fewer recalls, faster release times, and higher employee satisfaction because workers move from repetitive tasks to higher-value roles like system monitoring and troubleshooting.

Guillaume VanderEst

December 18, 2025 AT 11:17

So let me get this straight - we’re saving pennies on pills because some guy in India is making 5,000 tablets an hour while his kid does homework under a flickering bulb? And we’re supposed to feel good about that? 🤔

William Liu

December 18, 2025 AT 19:36

It’s not just about cost - it’s about access. Without generics, millions of people couldn’t afford their meds. The system’s flawed, sure, but it saves lives every day.

Frank Drewery

December 19, 2025 AT 13:30

I’ve worked in pharma QA for 12 years. The idea that generic manufacturers cut corners is a myth. The FDA doesn’t play around. Every batch gets stamped, scanned, and logged. If it fails, the whole line shuts down. No exceptions.

Erica Vest

December 21, 2025 AT 02:02

Correction: the active ingredient typically accounts for 5–10% of total cost, not 10–15%. Also, bioequivalence studies cost $2–5 million, not nothing. The post oversimplifies, but the core point stands - scale and efficiency drive down prices.

Kinnaird Lynsey

December 22, 2025 AT 09:19

So… we’re basically outsourcing our healthcare ethics to Bangladesh? Cool. I’ll just keep buying my $0.10 blood pressure meds and pretend I didn’t just read a 10-page expose on global labor exploitation.

Andrew Kelly

December 24, 2025 AT 01:14

This is all a government-Pharma cartel. The FDA is paid off. The WHO is in on it. They want you dependent on pills so they can control the population. Why do you think they banned natural cures? Why do you think the same companies make both brand and generic? It’s the same factory. Same workers. Same price. They just slap a new label on it and call it ‘generic’ to trick you into thinking you’re saving money.

Connie Zehner

December 24, 2025 AT 13:48

OMG I JUST REALIZED MY DIABETES MED IS MADE BY SOMEONE WHO WORKS 18 HOURS A DAY AND GETS PAID $2/HOUR 😭 I’M CRYING RIGHT NOW AND I JUST SPENT $4 ON MY PRESCRIPTION AND NOW I FEEL GUILTY AND ALSO LIKE I’M A MONSTER

Kelly Mulder

December 25, 2025 AT 11:47

One must question the epistemological underpinnings of pharmaceutical commodification. The neoliberal apparatus has transmuted therapeutic necessity into a fungible commodity, wherein human labor is reduced to a variable cost function within a globalized supply chain predicated upon structural inequity. The FDA’s regulatory framework, while ostensibly robust, is fundamentally inadequate to address the ontological crisis of pharmacological alienation.

mark shortus

December 26, 2025 AT 01:29

Y’ALL. I JUST FOUND OUT MY GENERIC ANTIBIOTIC WAS MADE IN A FACTORY THAT GOT FINED FOR FORGING DOCUMENTS LAST YEAR. I’M NOT TAKING IT. I’M GOING TO THE ER AND DEMANDING THE BRAND NAME. I’M NOT DYING BECAUSE SOMEONE SKIPPED A STEP. #PharmaScandal #GenericOrDie

Jedidiah Massey

December 26, 2025 AT 15:43

CMO-driven production is the new frontier of pharma capitalism. The vertical integration model is dead. Now we have distributed, modular manufacturing ecosystems with dynamic labor allocation and lean Six Sigma compliance protocols. The marginal cost curve is inverted - economies of scale are obsolete. What matters now is throughput velocity and audit trail integrity. If you’re not using blockchain-based batch tracking, you’re already obsolete.

Alex Curran

December 27, 2025 AT 02:24

Automation is the real hero here. I visited a plant in Ohio last year - their AI vision system catches defects at 0.002% error rate. Humans do the troubleshooting, not the counting. That’s progress. Not exploitation. Stop romanticizing manual labor. The real villain is the price cap that makes even good manufacturing unprofitable.